Price undercutting posing as a major threat to insurance sector

By O’Brien Kimani

Price undercutting is posing a major threat to the local insurance sector occasioning huge losses.

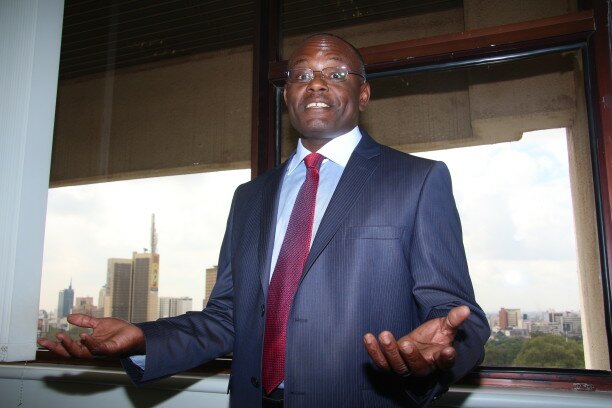

Liberty Life Managing Director Abel Munda says companies are being forced to eat into their capital base to remain afloat.

Munda attributes the practice to a cutthroat competition which is resulting in unpaid claims as has been the case in the motor vehicle third-party insurance segment.

Price undercutting or predatory pricing in the insurance industry refers to a practice where a product or service is set very low, with an intention to drive competitors out of the market, or hinder new players from accessing the market.

In Kenya, the practice is outlawed under the insurance and the competition acts. However, the practice continues to thrive posing a major risk to the local insurance sector.

Munda says price wars amongst insurers is hurting the business, stifling competition and driving some players out of the market.

In the year 2010, the Insurance Regulatory Authority (IRA) introduced the no claims discount rule in 2010 to curb undercutting.

A research by the industry regulator last year covering 30 chiefs of various underwriters found that the executives cited price undercutting as the most serious concern within the insurance industry, even worse than fraud which is also rampant in the sector.

Munda spoke during the launch of Maisha plan with Kenya Women Finance Trust that seeks to offer last respect benefits to the microfinance’s 800,000 customers.

The cover will be offered by KWFT at a cost of 75 shillings per day, where beneficiaries will receive a one off payment of 100,000 shillings in case of a member’s demise.